Table of Content

Performance information may have changed since the time of publication. If you want coverage for earthquake-related problems, consider an earthquake insurance policy. The majority of homeowners who have flood insurance buy it through the federal plan managed by FEMA, but you can potentially buy flood insurance from a private insurer.

Homeowners insurance consists of several protections that protect from common events like fire, theft, and smoke damage. This includes coverage for your dwelling, personal property, liability, other structures, and additional living expenses. Because most homeowners insurance companies will not cover a loss if you have rented out your home to someone else, it’s important to obtain dwelling coverage specifically for landlords.

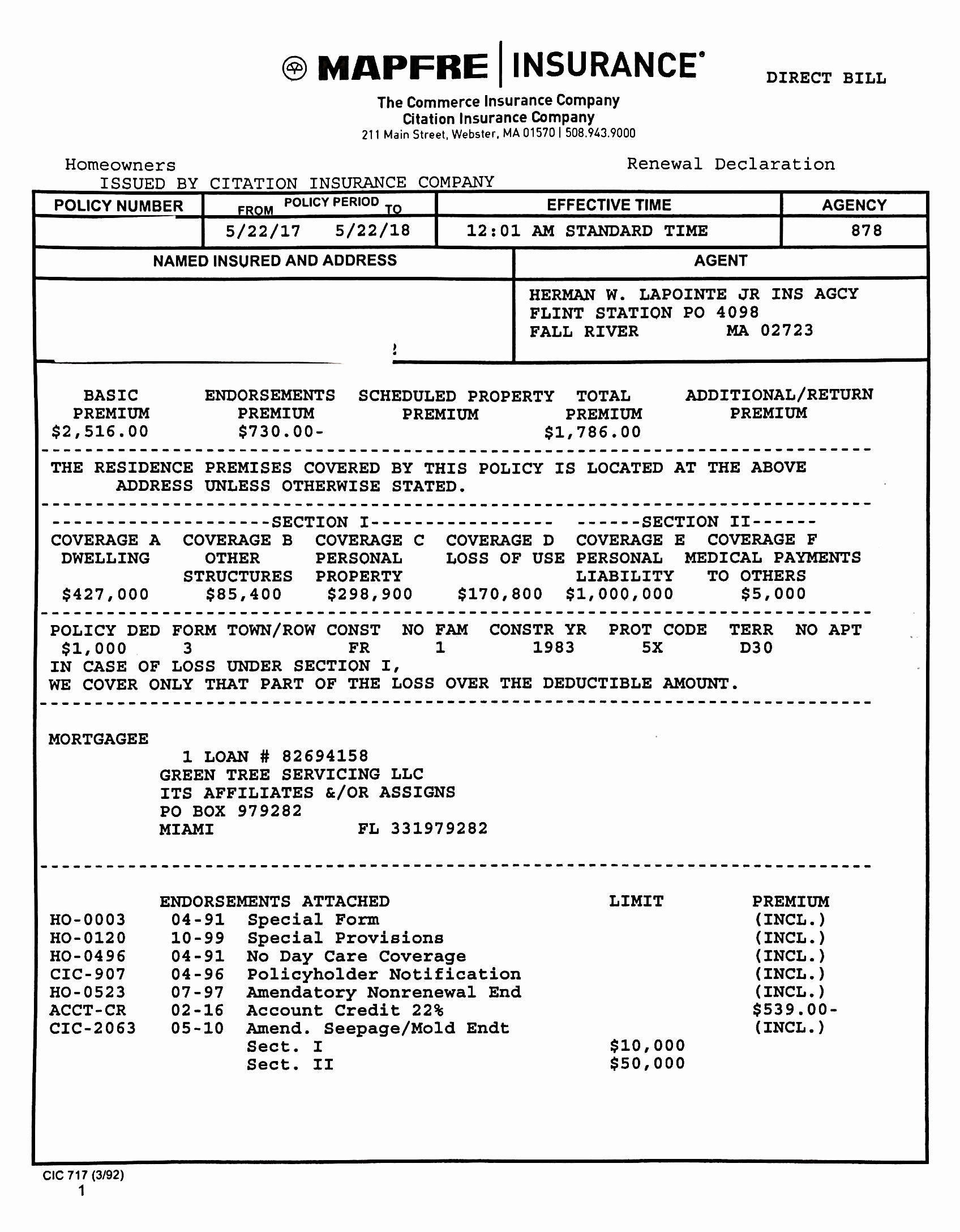

Average homeowners insurance costs

By contrast, full replacement cost is how much you would need to spend to actually replace the home in the event of a complete loss. Talk to your insurance agent about what is or isn’t covered by your policy so you can get additional coverage if necessary. Yes, a home insurance company may cancel your policy if your roof is old or in poor condition.

More expensive medical claims would be covered under liability insurance. This pays for minor injuries to others if they’re hurt on your property. This coverage is usually sold in small amounts, often between $1,000 and $5,000.

What does dwelling coverage not cover?

Most advise to choose an amount that’s around 20-30% of your Dwelling coverage. Also, take your lifestyle into consideration, as this covers what you’d usually spend on stuff like food, temporary storage of property, moving costs, etc. So let’s say you eat takeout everyday – breakfast, lunch, and dinner, you’ll most likely want to select an amount that’s more than someone who buys groceries and prepares their meals. While it’s tempting to look at the actual cash value of your home and assume that its market price right now will cover the cost to rebuild, don’t.

Not only do you pay a monthly fee, you typically pay a service fee each time a professional comes to your home. And if your roof is leaking due to age or wear and tear, you may need to replace the roof, which isn’t covered by a home warranty. You will likely have a deductible if your home insurance company approves a roof claim.

Find the Best Homeowners Insurance Companies Of 2022

A house with a structurally compromised roof has a greater risk of having a claim, which is one reason why home insurers put such an emphasis on a roof. These warranties often cover roof leaks caused by an old roof or general wear and tear, which home insurance companies usually exclude from policies. Many roofing experts agree that you can repair your roof if only a small area is damaged. For example, if a few square feet of shingles need to be replaced, you probably don’t need a new roof. But if a significant portion of your roof is damaged (40% or more), you should consider a full replacement.

Most homeowners insurance policies calculate your ALE as a percentage of your dwelling coverage—typically 20%—according to Insurance.com. If you have a large family , you should opt for the higher coverage if possible. Additional living expenses coverage is the part of your homeowners insurance that acts like an emergency fund if you’re temporarily displaced from your home. It covers things such as staying in a hotel or the added costs of eating at restaurants when you can’t cook at home.

Replacement cost is the actual amount of money it will take to replace the home you live in, assuming that it is completely destroyed by a covered peril or insured occurrence. While these figures are a great place to start, it’s important to determine how much your property and belongings are worth in order to find adequate coverage. You can always ask your insurance company if it can offer additional coverage, which comes at a higher price. Instead, liability coverage, also known as bodily injury damage, protects you and your guests from specific types of accidents, as well as any injuries caused by the policyholder. Expenses that are usually covered include medical bills, funeral expenses, and lost income. Most homeowners insurance policies offer the following types of coverage.

Many home insurance policies won’t cover certain types of claims if the house is vacant longer than 30 or 60 days. Your home’s structure comprises the roof, foundation, floors, doors, windows and walls. Dwelling coverage also generally includes anything attached to the structure, such as garages, porches, decks, and built-in appliances and fixtures. However, it doesn’t include your belongings, unattached structures or the land your home sits on. Additional living expense insurance covers additional costs of living incurred by a policyholder who is temporarily displaced from their place of residence.

You might also want to adjust the material you use (e.g., choose more eco-conscious materials). Fortunately, you have a couple of options for increasing your dwelling coverage policy limit. The specific dwelling insurance coverage protection offered by your policy depends on the type of policy you choose. Even with an HO-1 policy, though, you can rest easy knowing that you’re protected against fires, theft, vandalism, civil unrest and a car driving into your living room. Dwelling coverage is just one section of a homeowners, condo or manufactured home policy. The average cost of homeowners insurance in the U.S. is $1,784 per year, according to a 2022 NerdWallet rate analysis.

Read your exclusions and you’ll most likely see you’re not protected against floods and earthquakes, for example. If you have a high risk for specific natural disasters, your insurer may limit their protection in those areas. A cost-estimator helps insurance companies calculate how much it would take to cover your particular home, including what it would take to finish out the interior.